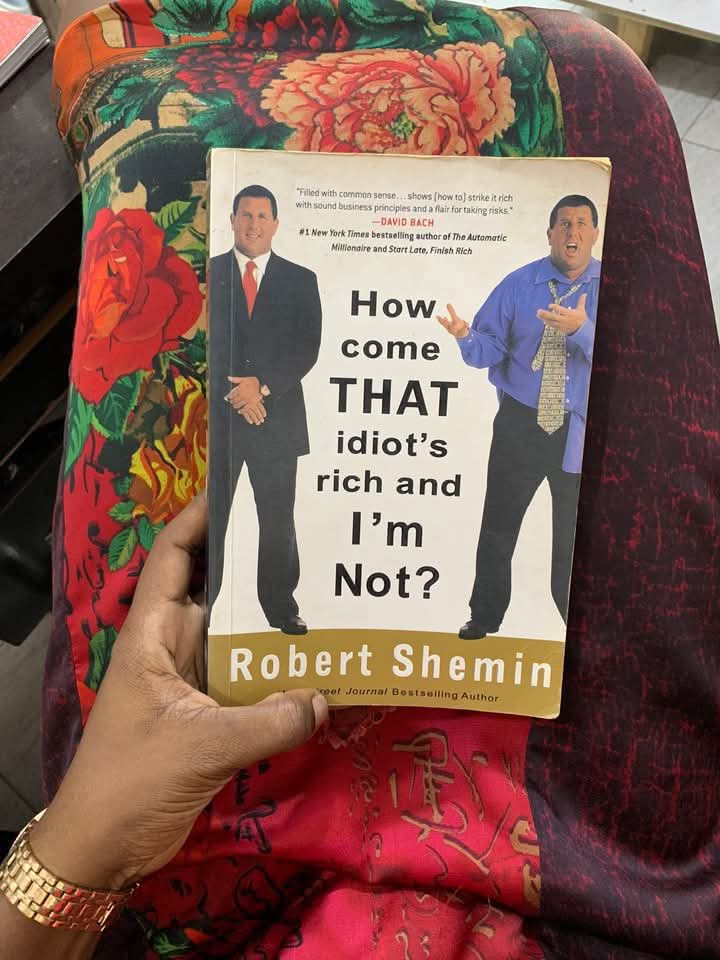

Here are 10 key lessons from How Come That Idiot’s Rich and I’m Not? by Robert Shemin. Each lesson dives deeper into the mindset shifts and practical actions that separate the wealthy from those who remain financially stuck.

1. Traditional Financial Advice Keeps You Broke

Many people believe that the safest path to financial security is to get a good education, find a stable job, save money, and avoid debt. However, Shemin argues that this advice leads to a lifetime of financial struggle. Traditional financial wisdom encourages playing it safe—working for someone else, saving small amounts, and avoiding risks—but it doesn’t create real wealth. The rich focus on building assets, using money strategically, and creating multiple income streams rather than relying on a paycheck. To break free from financial mediocrity, you must question the advice that has kept generations in the same cycle.

2. Intelligence Isn’t the Key to Wealth—Action Is

Many people assume that becoming rich requires high intelligence, advanced degrees, or expert knowledge in finance. In reality, the wealthiest people are not necessarily the smartest—they are the ones who take action. They make decisions, invest in opportunities, and learn from real-world experiences rather than waiting until they "know everything." Fear of making mistakes keeps many people trapped in analysis paralysis, while successful people act first and refine their strategy along the way. If you want financial success, start taking action today instead of endlessly preparing for it.

3. Fear Is the Biggest Obstacle to Wealth

Fear keeps people stuck in their financial situations. Fear of failure, fear of losing money, fear of making the wrong choice—these anxieties prevent individuals from taking the risks necessary to build wealth. The wealthy acknowledge their fears but don’t let them dictate their actions. They understand that failure is temporary and that mistakes are valuable learning experiences. The key is to push past fear by taking small risks at first, gaining confidence, and realizing that setbacks are just stepping stones to success.

4. The Wealthy Focus on Assets, Not Just Income

Most people measure financial success based on how much they earn, but this is a flawed approach. A high salary doesn’t guarantee wealth if all the money goes toward expenses. The rich focus on acquiring assets—things that generate income, such as rental properties, businesses, stocks, and intellectual property. Assets continue to make money even when you’re not actively working, which is why building them is the foundation of financial freedom. Instead of asking, "How much do I make?" start asking, "What assets am I building?"

5. Leverage and Other People's Money (OPM) Are Game Changers

The wealthy rarely use only their own money to build wealth. They understand the power of leverage—using other people’s money, skills, and resources to accelerate financial growth. This could mean using loans to invest in real estate, partnering with others to start businesses, or outsourcing tasks to free up time for higher-value activities. Instead of saving for years to make a big investment, successful people find creative ways to make deals happen sooner. The lesson is clear: you don’t need to have all the money yourself—you need to know how to access and use it wisely.

6. Failure and Mistakes Are Necessary for Success

Most people try to avoid failure at all costs, but Shemin emphasizes that the wealthy fail more often than the average person—they just learn from it and keep going. Mistakes are not the opposite of success; they are part of the process. Instead of seeing failure as a setback, wealthy individuals view it as a necessary step toward financial success. The difference between rich and poor isn’t who makes mistakes—it’s who learns from them and keeps moving forward.

7. Networking and Relationships Build Wealth Faster

Financial success isn’t just about what you know—it’s about who you know and how well you connect with them. Wealthy people surround themselves with successful, ambitious individuals who inspire and challenge them. They actively build relationships with mentors, investors, business partners, and experts who can offer guidance and open doors. Many financial opportunities come through personal connections rather than job applications or online searches. If you want to grow your wealth, expand your network and nurture valuable relationships.

8. Your Mindset Shapes Your Financial Reality

Your beliefs about money directly impact your financial success. If you see money as scarce, difficult to obtain, or something only lucky people have, you’ll subconsciously make choices that reinforce that belief. The wealthy believe in abundance—they see money as a tool, opportunities as limitless, and financial success as achievable. Shemin emphasizes the power of reprogramming your mindset to see wealth-building as natural and possible. If you constantly tell yourself, "I’m not good with money" or "Rich people are greedy", you will sabotage your own financial growth.

9. Pay Yourself First and Control Your Spending

Most people pay their bills first, cover their expenses, and then save whatever is left—which is often nothing. The wealthy do the opposite: they pay themselves first by setting aside money for investments and savings before paying other expenses. This ensures that wealth-building is a priority, not an afterthought. Additionally, they control their spending—not by living in poverty but by making intentional choices about where their money goes. Financial success isn’t about being cheap—it’s about being smart with money and directing it toward wealth-building activities.

10. Take Responsibility for Your Financial Future

Many people blame external factors—bad luck, the economy, their upbringing—for their financial struggles. The wealthy, however, take full ownership of their financial situation. They don’t wait for the government, employers, or family members to secure their future—they take proactive steps to build wealth themselves. Taking responsibility means educating yourself, making strategic financial moves, and refusing to make excuses. The sooner you accept that your financial future is in your hands, the sooner you can start making decisions that lead to success.

You can also get the audio book for

FREE using the same link. Use the link to register for the audio book on Audible and start enjoying